These stocks, when the timing is right have rocking momentum to the up and downside. This all comes from being lower float stocks and typically having a highly shorted float percentage to them.

SGY Float :4,924,000

ETRM:1,613,000

GLBS: 3,662,100

ZYNE:6,537,500

When the momentum starts the chart as you will see tends to spike at open, have a nice little pullback and then surge again before lunch. Here are two different stocks that ran this week and the similar set up that I am talking about. SGY on the left and ETRM on the right

As you can see there is momentum right off the bat typically due to news of some sort and the inital shorts that see this happening and start to buy to cover their positions. So the upward movement happens with shorts buying, their stops being executed and also new buyers with momentum. Then you have the new buyers that take some profits and some shorts that get on board. The stock sells off and finds a new support, consolidates and runs again with many times surging through the previous high and burning more shorts in a squeeze.

As with GLBS from last week I was long from 6.06 on Friday then it was halted with news that was speculated from their prior press releases to dilute the overall number of shares of the company and drop the value of the stock. Well the news released after the halt said that this secondary financing was not going through and although the company in the long term needs to find financing the immediate drop in share price was not due to happen. More than 50% of the float was short from Friday and when the fear set in on Monday it drove it right back up and then some.

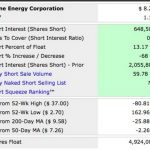

The same has been true for SGY going into friday. On Thursday there was news that the company was a good long term value buy and the share price rose some. Then the short float that sold the chart on Thursday was 59% of the volume. I find these numbers with shortsqueeze.com premium service. To me it is well worth the small monthly fee to see the % short sold of the volume from the day before. This is a sample of the information that I am talking about. SGY Thursday data on left and Friday data on the right.

I will definitely be watching SGY going into Monday for more squeeze potential because it has held its value even with 48% of Friday’s volume being short. That means that roughly 2.7 million shares wer sold short on Friday. It does not take into account the momentum buyers and sellers that rode it up and took profits along the way. The stock has been a multiday spiker when you look left in the chart and when the momentum is there to the upside it can cause major runs. And this stock has been recommended as a good value stock for the longer term investor and it has seen two good days of upward momentum and the value investor would love a nice 30% return like this has been showing lately.

These stocks are great because you can take large percentage moves in a day, but the action is very fast and hard to set a hard stop as they tend to get executed by Market Makers with the volatiliy very quickly.

I honestly trade these stocks uber conservatively and take profits way too soon because I am cautious about them pulling back. And what goes up can go down just as fast in the low float world. When there is demand it runs up quickly and when people sell and want to dump their shares it can go down just as fast if not faster. I try to always sell into strength as it is easier to get a fill with buyers. When it is dropping down it can be hard to get a limit to execute if you are not finding people to buy.

Now you ask how do I find these stocks that are moving like this. Well it is a custom alert alert that I use with Trade Ideas. It is amazing software and you can create alerts for any style of trading. Everyone has their own type of alert system that they enjoy using whether it is an email service, squawk service (like Benzinga) or text alert or chat room. I enjoy the audible part of Trade Ideas as I know I’m an audbile learner and I can easier type the ticker without having to filter through alerts visibly and take my eyes off my charting screen.

Everyone at some point or another gets the news to find stocks moving but it is the ones that are able to find them in the beginning of the movement that are at an advantage. Being late to the party can end up in losses over and over to the long side. These short float stocks are great when they crack if you can get shares, but be cautious of the the short squeeze against you.

If you have been following me for a while or just new to following me I am 2.5 weeks away from the estimated due date of my second daughter. I am working very hard to get my book off to the editors before she arrives. In the meantime before delivery I will keep all of the blogging and tweeting and videos up as long as possible, but there might be a couple weeks where I take a break to take care of the new bundle of joy. I have a passion for stocks and sharing and helping others grow.

Our own successes come from the energy and dedication we put forward to making our dreams reality.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon. If you want me to email you as it is available shoot your name over to carpeprofit@gmail.com.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. There be an open house for just $8.88 for a week to test the full premium services starting Feb. 6th.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Hi, I like your articles. Had a comment regarding shortsqueeze.com. Based on your screenshots, it doesn’t seem that shortsqueeze update short interest data daily (as the number are the same). Instead, it seems to just divide the daily total volume by it to get the daily short volume data. Agree?

The overall short float is updated twice a month. For the premium data on short squeeze you are 100% correct in that they analyze the total number of shares sold short out of the volume for the day. That doesn’t mean all the shares are still short at close. However it gives you an indication of the overall sentiment people have for the stock and the potential of shares that could be short and looking to cover should the price action go against them.

Thanks for the answer! Just wanted to confirm that shortsqueeze.com’s premium version is not providing short data that can’t be found elsewhere for free (such as Nasdaq.com). Instead, it seems the premium version selling point is that it does useful calculations for you (e.g. bi-weekly short interest with respect to daily volume).

The bi weekly is free to everyone the premium is the analysis yes of the short volume vs daily volume which is paid information everywhere that I know of and I found there’s to be the most cost efficient.

Thank you Jane! Great email. Good luck with the young one coming soon.

Regards,

Draednought