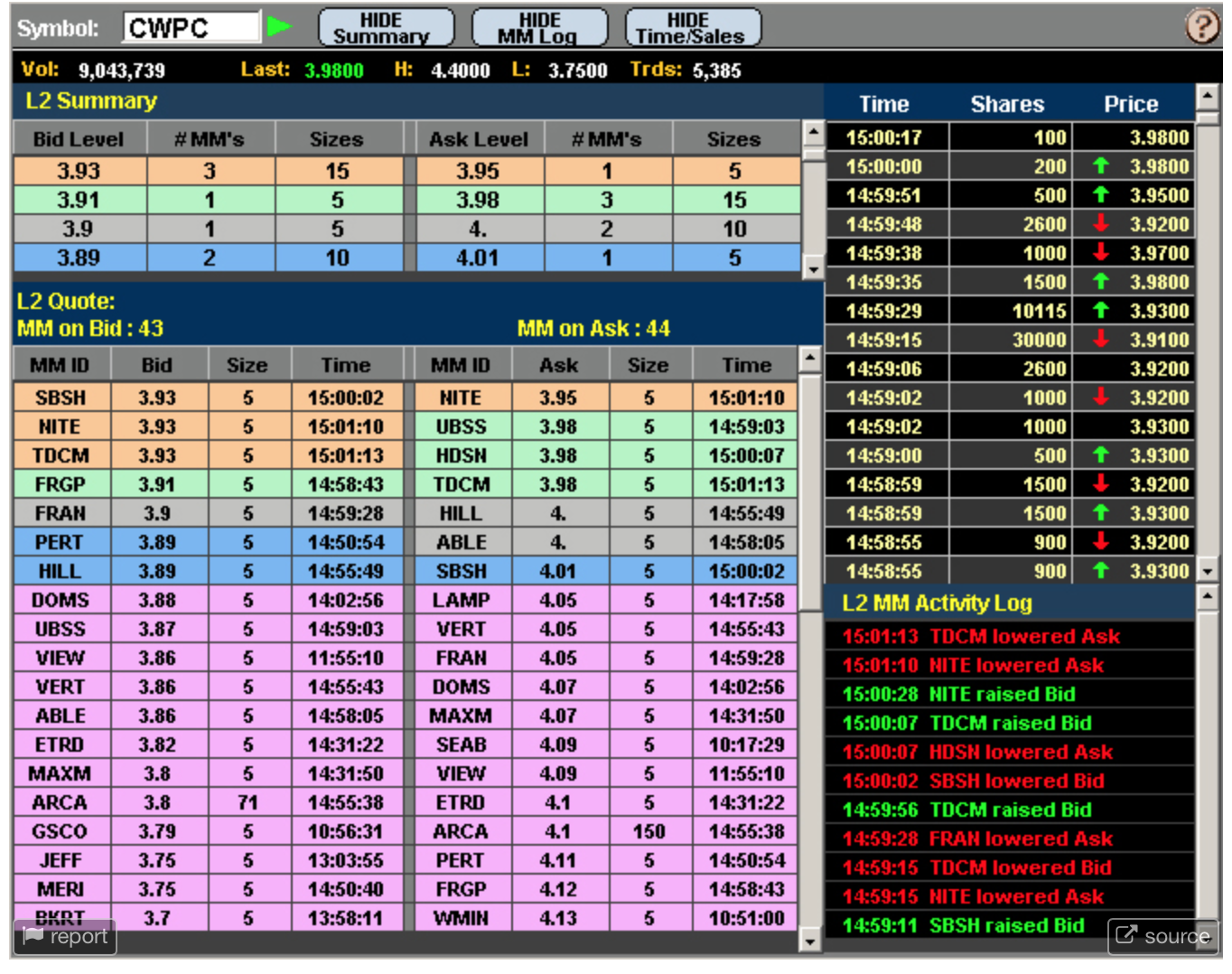

I have been having people sending me requests to write about Level 2. I definitely rely on Level 2 as well as Bollinger Bands to help determine my entry and exit with a stock. For me when I see the price action or the sales going through at the price on the Ask side there are more demand for the stock and they buyers don’t want to always wait for the bid price so they go in at market or Ask. That would be a strong indication to me that the momentum is in the long direction. Once I see the price action change and the sales are going through at the Bid price consecutively there is less demand for the stock so the price is dropping and people don’t want to wait for the Ask price so they are willing to sell at the Bid.

Sometimes there can be large buyers or large sellers that show a support or resistance level, but if the momentum is moving fast enough those sellers or buyers orders are eaten up and the movement continues.

As with JWN, ENDP and CLRB on Friday I could tell from the price action that all those shares were exchanging hands with high volume and the price was fairly flat for the second half of the day, so the stocks would have covers happening on Monday morning. These shorts covering and the investing buyers would cause the people that shorted on Friday to cover creating more demand and driving the price up. My understanding allowed me to profit almost $5,000 in the first 15 min of the trading week. I learned from 1 week ago and I walked away happy with meeting my weekly goal in 15 minutes.

My 4 stocks that I have long right now are INSY 14.37 , ENDP 15.36 , LE 17.21 and ZAGG 5.19

INSY from Finviz.com is showing 24% short float interest. It has had 9 days of upward momentum. Today at 651 from Briefing.com They have passed their phase 1/2 for their new cannabidiol drug.

6:51 am Insys Therapeutics announces ‘successful’ completion of phase 1/phase 2 safety & pharmacokinetic study in pediatric subjects with treatment-resistant epilepsy being treated with cannabidiol oral solution (INSY) :

“We are excited that our synthetic pharmaceutical CBD in a non-alcoholic, medium chain triglyceride-based formulation was studied up to a daily dose of 40 mg/kg in subjects with pediatric epilepsy. The data is currently under analysis, and the CBD appears to have been generally well tolerated,” said Dr. John N. Kapoor, Chairman, President and Chief Executive Officer of Insys Therapeutics

“We anticipate meeting with the FDA to discuss the subsequent steps for this program, as well as the development program for the treatment of Dravet syndrome and Lennox-Gastaut syndrome, two rare forms of pediatric epilepsy for which Insys’ pharmaceutical CBD formulation received orphan drug designation. Additionally, we have an ongoing trial evaluating CBD in infantile spasms, a catastrophic form of childhood epilepsy. These efforts underscore our commitment to advancing our pharmaceutical CBD program in pediatric epilepsy and we look forward to updating you on our progress in due course,” added Dr. Kapoor

I have been holding INSY as a swing trade because the stock was so beaten down hanging around the 52 week lows. The high short float interested me knowing that as soon as there is volume behind upward price action it should drive the price up fairly quickly. Also the CEO bought 50K shares back on 5/11 and the CFO just exercised his options 5/23 for 10,000 shares. When the two insiders are going long it is a pretty good indication that positive supporting news is coming out.

For ENDP I have had this one on watch and trading it almost each week as it seemed to keep hitting a new 52 week low. Until last week. Then we saw Billionaire John Paulson invest 30% of his initial holdings and the stock has had nice upward momentum to recover some of the loss in value over the past year from a stock price of $90. It actually looks like the shorts have wised up and the float has decreased down to 2.73%. That would also lead me to believe the shorts think this stock is going to continue growing.

LE is another retailer that has been beaten down and with the news of the marketing director stepping down it lost some additional value. This week it is setting new 52 week lows, but has been holding 17 support fairly well. The short float on LE is 18% and the RSI on daily chart is 18.75. The volume has been light just 150K shares traded today. Once there is movement on this stock it should surge upward nicely. Earnings are due to be reported 6/1.

My last long position is ZAGG with the two days of new 52 week lows. They just announced their earnings 5/10. My main reason for going long besides the 18% short float and the new 52 week lows is that the CFO just bought 10K shares of the company. To me the CFO knows the financial health of the company and knows a good point to invest in the company.

As always I hope that my blog posts help you in your trading adventure. Remember to study hard and if you are just starting be kind to yourself. Position small in the beginning to limit your losses and gain confidence with profits. Once you see you are profiting more often than losing slowly add to those position sizes.

If you have any questions or comments you can always reach me here on my blog with comments,Twitter, Profitly , Instagram, Facebook or LinkedIn.

I love hearing your success stories so feel free to share. They also inspire others.

This blog is for information purposes I am not a registered securities broker-dealer or an investment advisor. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Thanks for the advise “Position small in the beginning to limit your losses and gain confidence with profits. Once you see you are profiting more often than losing slowly add to those position sizes” I will keep it in mind!

Do you give Private lessons? Im from Mtl too. If so, how much do you charge for lets say 3 courses? Or I dont know how you’d do it. Let me know, Thx in advance.

Greg shoot me a message on my Facebook page.

Thanks for the advice Jane. Always helpful. Just a quick question.

Apart from Tim Sykes, did you study any other traders courses, dvds etc… when you initially started learning about trading?

Ish,

I also watched Ross Cameron’s free videos on YouTube and I’ve learned a bunch from Trade Ideas Free Trading room.

Hi Jane. Thanks for your useful posts. They really do help.

Just a quick question. Apart from Tim Sykes, are there any other traders you learned from when you started from the beginning?

Really it was Tim then warrior trading for a while and now I’m in Trade Ideas trading room and find my stocks and if they aren’t working trade ideas

Hi Jane, what do you think of Warrior trading courses? I would be interested in learning from you as well. Do you offer training? Thanks. Have a great weekend!

Lam send me a message on Facebook to talk about that. I would recommend watching all the free videos you can on Warrior Trading on youtube and TickerTV. In the beginning free education is always great, however you also get what you pay for with content quality.

Hi Jane,

What did you think of Warrior Trading Courses? Was it worth it? I would also be interested in learning from you. Please give me more info. Thanks!

I never took their course just sat in on the chat room. I like that they have 4 traders in their all different styles to help you figure out what style works best for you.