by Jane | Jan 22, 2017 | Uncategorized

These stocks, when the timing is right have rocking momentum to the up and downside. This all comes from being lower float stocks and typically having a highly shorted float percentage to them.

SGY Float :4,924,000

ETRM:1,613,000

GLBS: 3,662,100

ZYNE:6,537,500

When the momentum starts the chart as you will see tends to spike at open, have a nice little pullback and then surge again before lunch. Here are two different stocks that ran this week and the similar set up that I am talking about. SGY on the left and ETRM on the right

As you can see there is momentum right off the bat typically due to news of some sort and the inital shorts that see this happening and start to buy to cover their positions. So the upward movement happens with shorts buying, their stops being executed and also new buyers with momentum. Then you have the new buyers that take some profits and some shorts that get on board. The stock sells off and finds a new support, consolidates and runs again with many times surging through the previous high and burning more shorts in a squeeze.

As with GLBS from last week I was long from 6.06 on Friday then it was halted with news that was speculated from their prior press releases to dilute the overall number of shares of the company and drop the value of the stock. Well the news released after the halt said that this secondary financing was not going through and although the company in the long term needs to find financing the immediate drop in share price was not due to happen. More than 50% of the float was short from Friday and when the fear set in on Monday it drove it right back up and then some.

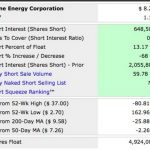

The same has been true for SGY going into friday. On Thursday there was news that the company was a good long term value buy and the share price rose some. Then the short float that sold the chart on Thursday was 59% of the volume. I find these numbers with shortsqueeze.com premium service. To me it is well worth the small monthly fee to see the % short sold of the volume from the day before. This is a sample of the information that I am talking about. SGY Thursday data on left and Friday data on the right.

I will definitely be watching SGY going into Monday for more squeeze potential because it has held its value even with 48% of Friday’s volume being short. That means that roughly 2.7 million shares wer sold short on Friday. It does not take into account the momentum buyers and sellers that rode it up and took profits along the way. The stock has been a multiday spiker when you look left in the chart and when the momentum is there to the upside it can cause major runs. And this stock has been recommended as a good value stock for the longer term investor and it has seen two good days of upward momentum and the value investor would love a nice 30% return like this has been showing lately.

These stocks are great because you can take large percentage moves in a day, but the action is very fast and hard to set a hard stop as they tend to get executed by Market Makers with the volatiliy very quickly.

I honestly trade these stocks uber conservatively and take profits way too soon because I am cautious about them pulling back. And what goes up can go down just as fast in the low float world. When there is demand it runs up quickly and when people sell and want to dump their shares it can go down just as fast if not faster. I try to always sell into strength as it is easier to get a fill with buyers. When it is dropping down it can be hard to get a limit to execute if you are not finding people to buy.

Now you ask how do I find these stocks that are moving like this. Well it is a custom alert alert that I use with Trade Ideas. It is amazing software and you can create alerts for any style of trading. Everyone has their own type of alert system that they enjoy using whether it is an email service, squawk service (like Benzinga) or text alert or chat room. I enjoy the audible part of Trade Ideas as I know I’m an audbile learner and I can easier type the ticker without having to filter through alerts visibly and take my eyes off my charting screen.

Everyone at some point or another gets the news to find stocks moving but it is the ones that are able to find them in the beginning of the movement that are at an advantage. Being late to the party can end up in losses over and over to the long side. These short float stocks are great when they crack if you can get shares, but be cautious of the the short squeeze against you.

If you have been following me for a while or just new to following me I am 2.5 weeks away from the estimated due date of my second daughter. I am working very hard to get my book off to the editors before she arrives. In the meantime before delivery I will keep all of the blogging and tweeting and videos up as long as possible, but there might be a couple weeks where I take a break to take care of the new bundle of joy. I have a passion for stocks and sharing and helping others grow.

Our own successes come from the energy and dedication we put forward to making our dreams reality.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon. If you want me to email you as it is available shoot your name over to carpeprofit@gmail.com.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. There be an open house for just $8.88 for a week to test the full premium services starting Feb. 6th.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Jan 14, 2017 | Uncategorized

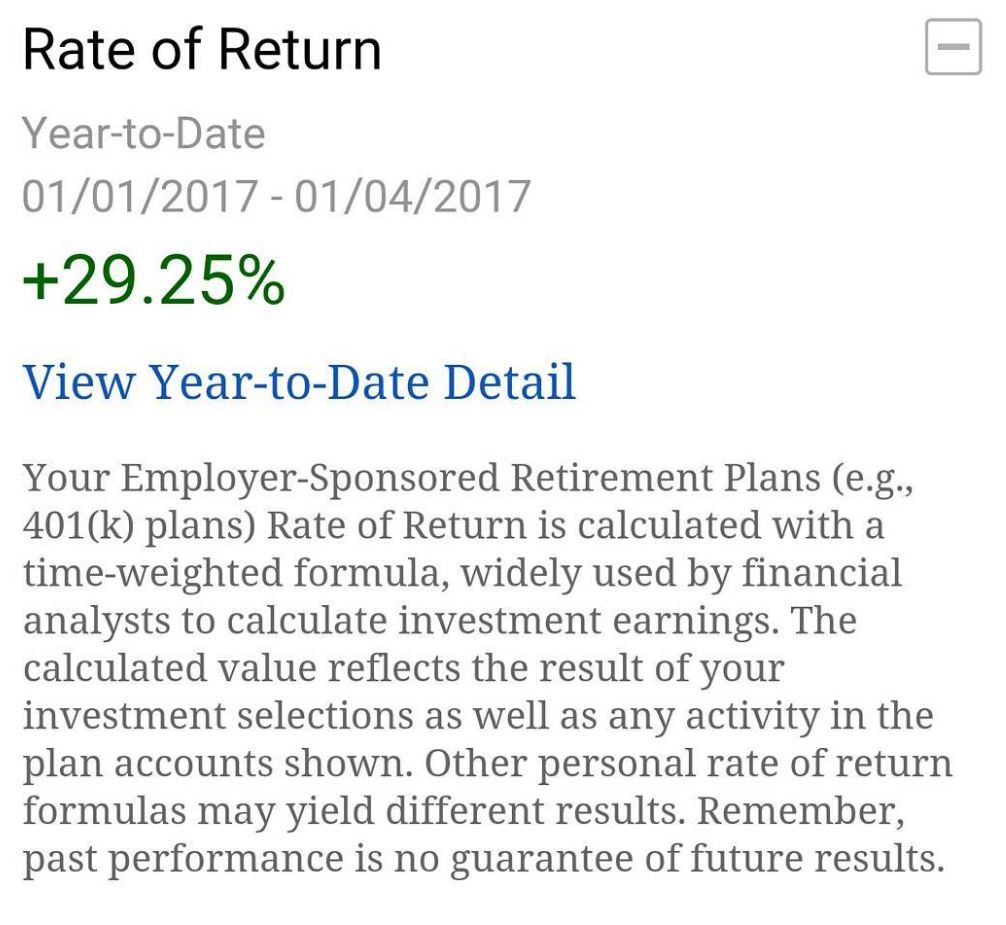

In the past year of trading I also discovered 3x ETFs or ETNs to really grow my 401k. Last year from Febuary to June I gained 100% in my 401k trading UWTI and DWTI. The ETFs are great because the 3x means that the volatility and price action tends to be 3 times as strong in the trend direction.

Now this can be quite a benefit as long as you are on the right price action. If you get caught in the wrong direction it can also eat away at capital very quickly. So I what I learned is to make sure to protect that capital with a stop.

I will usually go in with a bracket of a trailing stop on the sell side and move it tighter once I’m in the money or above my entry price. I like to do that to make sure that I lock profits and protect capital.

Last year oil was at all time lows and so trading DWTI and UWTI was very profitable. This year I saw the all time high in the price of Natural Gas and with my RSI extreme knowledge and knowledge general of price action I traded DGAZ and UGAZ.

I took a nice 29% profit overnight when the Natural Gas price pulled back from highs however I now know I was conservative and could have made almost 85% in 4 days. Once it looked like DGAZ was at an extreme I went long UGAZ and my entry was actually one day too early.

There is always room to learn something new and how to trade them. I like ETFs for the 401K as I like to just “crockpot” the trades or swing them with the bracket orders. The natural gas numbers I know are now announced every Thursday at 1030 EST and usually there is an extreme reaction one way or the other based on the news. As I see the extreme happens like a stock spike and then you can trade the reverse to get a quick intraday trade.

The same occurance happens when Oil numbers are announced on Wednesdays. For now these are the only two that I have traded and I am starting to learn how they react to news and price action.

As with stocks once you start to study and action see the patterns of that particular financial instrument you can see ways to grow your account where your risk is mitigated.

I am definitely not the be all master of stocks, but I enjoy helping to share my experience to help others in their journey. When you put in the work and continue to learn you can only get better. I’m also someone that believes the more you share the more it comes back to you and I look to help others succeed. There is great satisfaction in hearing that others have profited or learned along the way with a little motivation from my journey

This week has been a busy one with finishing up chapter one on the book and 9 more to go before sending it off to the editor. I can’t wait to share it with all of you. IT is not just my experience, but others as well which is what really helped me in the beginning.

I am officially 3 weeks away from my little one’s due date on Monday so I might be a little MIA once she is born to give you a heads up. With my first I had high blood pressure and had an emergency c section 1 week early, so praying this one has no issues and she is born naturally. Out of my control like market price action and I will react based on what is presented to me.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon. If you want me to email you as it is available shoot your name over to carpeprofit@gmail.com.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Discount Code for Sunday and Monday for MLKDAY for up to 20% off and there will be an open house to test the full trial starting Feb. 6th. Stay tuned for link for open house.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes. I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Dec 26, 2016 | Uncategorized

This past week has been another whirlwind. I have been working hard at getting the book rocking and rolling along. Set up a trademark and did 2 more interviews with women. One in Toronto and one in Dubai. It is amazing to hear their journies and I look forward to sharing them all come publication date.

As for trading the week had strongward upward momentum for positive stocks and the loser stocks seemed to continue a downtrend.

$PTLA was a huge winner with their drug being approved. It went up 30% after the 2:12pm announcement that the FDA approved the drug. The last time we saw a huge run like this was $SRPT back in September on the 19th where it went up 80% in one day. I’m curious to see if the momentum continues tomorrow as there was the long 3 day weekend for the positive news to set in as everyone chatted away with eggnog and spirits.

My analysis and my opionion as I’m not a financial advisor is the shorts did not want to hold onto their short position A. over the long holiday weekend or even the last week of the year. There is less volume during these two weeks however if it is a lower float stock they leave themselves open to disaster if away from their trades as a short swing trade.

As for the losers dropping more many longer term investors are selling off for capital gains tax purposes. So this can lead to some bargain hunting. It was Dec 21st last year that I bought WYNN around 51 I believe and then by March it was back to 100. I was way conservative and only took about $6 profit on my shares.

I went out of my comfort zone on Friday and tried trading live with a webinar of people listening in and sharing my screen of Trade Ideas alerts. It was far more challenging than I expected it to be. I believe it is because in that hour I wanted to do a live trade and also answer questions. For me if just isnt possible to talk through a trade well and field questions. I went long CTAS and got out at my stop. If I was by myself I think I might have given it the wiggle room it needed to run up roughly $3 from my entry.

So I applaud all those that have their own trading room and are successful at teaching others and trading at the same time. It will be a little bit for me to get that under my belt.

So for now as you know I’m 6 weeks away from my guess delivery week of second week in February and the hormones have kicked in to cause me to nest.

All of a sudden it was….Oh I need to buy diapers, we need to move furniture, I need to get her clothes out and clean, dont forget the hospital bag.

All these things swimming through my head at the moment, so I know that I must trade smart this week as our baby is definitely on my brain.

I hope that you had an amazing holiday weekend with family and friends. That is what life is about. The love that you share with the people around you. Money makes life easier, but when you are in your grave it is the time you shared with people that matter that is more important than the size of your bank account.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Discount Code through Tuesday Dec 27th is HOLLYDAY for up to 25% off. Next week long Open house is coming in January for full pro trial for more than likely less that $10 to sample the software.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Dec 18, 2016 | Uncategorized

This week was another crazy busy week. In trading $ALXN I was rocking with the bottom bounce on Monday and then the nice reversal all week to end up $10 from the bottom on Tuesday at 110. I traded both the stock and options for a nice profit on the name.

With Options I am learning it is even more important to cut the losers quickly because it can grow into an exponential loss with the expiration date cutting the value of the option as well as the stock moving against you.

$AKAO had some great movement on Monday and I traded it for nice gains and went long just before close as a strong stock with momentum looking for the gap up on Tuesday morning. Well at 4:01 I have a trading buddy with Benzinga News and I got a message they were going to do an offering. I reacted to the news and sold for a loss after hours.

$UHS was another great winning stock I traded both long and short on Wednesday. I was timing the momentum well and banked on reading the chart based on RSI and Bollinger bands.

Wednesday was another big day as I was honoured to be interviewed by Jeremy Newsome of Real Life Trading. Jeremy like myself has the goal to really help others profit and learn in the trading world. It is coincidental that we met up through one of my followers Dee who also lives in Nashville. The internet is a wonderful thing. Here is the interview.

Wednesday evening I also had the pleasure of doing another interview for my book about female traders with Latoya who also happens to be a moderator for the Real Life Trading room and has two little ones in her office/playroom while she trades. It is so amazing to hear others’ stories about how they made it to become successful in the trading world.

My book is in the process of being written and hopefully off to the editors come Jan. 1st. My goal is to be able to tell you guys it is available in print and ebook by Middle of February when our little one is due.

Thursday I traded $UHS and I was not trading the chart but trading with hope. It does happen to me sometimes too. When my mind is not in the right place and I think no this stock has gone up so much it must come down. I shorted and exited at stops then resorted and exited at stops and I was trading the wrong side of it throughout the day. So I had a red day on Thursday. Sure enough it was Friday with the trend of the market that UHS ended up

Friday which tends to be my strong day started out rough with the internet crashing before open. OK got that fixed. Then my charting software half of the charts wanted to work. Frustrating and then I was in bounce positions on OFIX and AGIO my broker site went down. I was in the midst of setting up limit orders to execute for the bounces and it went down. So I called in the orders and made a bit. Then I saw JWN on the biggest losers list. In my head it was so oversold and it needed to bounce. So I went long at 11. Well it continued down and I got distracted and ended up taking a $1 loss/share. It ended up being another red day based on JWN.

Overall another great week of profits bringing my month profits to roughly 5k. Not as good as some months this summer but. I am trying to get a lot done before our second daughter is born.

I am loving being able to share my experience to help empower women to step into the trading world. The biggest hurdles we have in life are the ones in our mind. So once we break down that fear and take little steps into the uncomfortable and move forward we make progress. Many time progress comes from stepping into the uncomfortable world and learning something you thought impossible. Thats when the impossible becomes possible.

Super excited about the book and I have a new fire in me to really make it happen to help others. It is a tool I wish that I had at my fingertips when I started really day trading a year ago.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Next week long Open house is coming in January for full pro trial for more than likely less that $10 to sample the software.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Dec 7, 2016 | Uncategorized

It was roughly one year ago, November 2015, that I began my daytrading for the second time with small amounts of money. I was still struggling to figure out the best trading strategy. At this time I also read the book Momo Traders and it inspired me to then work on reaching out to more women about trading.

I realized at that time, there are not many women traders out there to help encourage women to be active traders. So I began working on a book about female traders. Hopefully this will be coming out early 2017 and I will of course keep you informed. There are definitely female traders but not many that want to break down the mental barriers to help others succeed at trading.

I felt the best way to help others is to share my experience along the way and that is what the Women Empowering Women Seminar by Trade Ideas was all about this past weekend. You can view the full recording here Literally I started as an aspiring day trader in my basement office not knowing much and now I’m honored to help inspire others.

It was roughly one year ago when I opened my Twitter account and I went to my husband….Look Honey I have 10 followers. As I began sharing and blogging and tweeting everything grew. I began with Twitter and then people started asking questions, so I began sharing and I thought a blog is an efficient way to answer the questions that I received from multiple people in one forum.

Thus this blog was born and created to share to answer questions that I receive often. This past September I went to the Trader and Investors Summit and was honored by Timothy Sykes with my success thus far as a female trader. My hubby is a big YouTube fan and so I began doing my weekly video about my week in review and answering more questions as well. Slowly as more questions come in I try to film the answers. I also want to share the real point of view not the shiny happy everything is great trading view.

My openess to share my journey led me to being the keynote speaker at the event sponsored by Trade Ideas. It was an absolute honor to share my journey that has been just a year so far. I have big visions for helping more women put the fear aside as far as learning how to trade.

The biggest hurdles in acheiving any dream is the one you present in your mind. Once you put your fear aside and start putting your energy towards your goals and dreams you see you future changing before your eyes. Day by day all the efforts you put out create your new future. Before you know it you have changed your life to be living your dream as reality.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpeprofit@gmail.com or YouTube

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

by Jane | Nov 29, 2016 | Uncategorized

In the beginning of my day trading journey using Timothy Sykes Tools I learned all about pump and dumps, but I never had the opportunity to short one. Well today with Interactive Brokers I was able to get shares. I tried to short when it was up at $8 but there were no shares available. The chart was looking over extended being up 100% on the day and knowing how the shippers have not been able to hold their spikes from DRYS a couple weeks ago I thought this is a great short.

Well I got shares to short at 7.17. I was trying for 700 shares and only got a partial fill at 500. Then as soon as I got my notification that the shares were sold I went to check the stock and boom it was halted.

Immediately I went and googled Nasdaq halted stocks an sure enough there was GLBS with the T12 code : Pending more news. Then there were rumors on Twitter it was going to be halted for 30 days. The last news that I had seen was there was a new executive joining the team and it skyrocketed from $3.80 up to$8 10:50-12:20. With such a dramatic increase in an hour and a half it seemed that is should pull back. So I thought this is a perfect opportunity for a short so I put in the request.

I was a bit hesitant that the stock was going to go up but it had already been halted twice during the day going up and usually I see the third time it tends to sell off. So as soon as I had the shares I shorted.

The afternoon was exciting while patiently waiting to hear why this stock doubled. The last time I was in a stock halted pending news it was ENF where there was news of them being bought out by a Japanese company and sure enough this one spiked once the news was released that the offer to buy them was confirmed.

So not knowing the news was a bit tense but exciting. Knowing that DRYS had just been through a similar situation and sure enough after the halt the stock opened down 50%. As soon as I saw the update on the Nasdaq site for the stock to reopen at 3:35 pm I went in search of the news that was released.

I found the news that they were due to issue shares at 1.60. I had an order in earlier to cover at 4.17 for a conservative $3 a share profit. Well I then saw on level 2 that the sellers lowered their Ask price to 4 so I dropped my buy to a more agressive 2.17.

I was actually on the phone with my husband when it opened and it was open at 2.88 for roughly 18 seconds before they halted the stock again. I thought ok it will continue dropping further so I was even more aggressive with 1.87 for my covereage. It reopened and started dropping. I saw it going down and thought I don’t need to be greedy I’ve already made over $2000 on a $3585 position. So I set a trailing stop for .17 and let it work. No matter what happened if it continued down I would still profit. So my position locked in profit at 2.795.

It was an exhilarating experience to have the opportunity to short a pump and then have it halt and go in the perfect direction and open with not a 50 cent gap but almost $5 gap. I only wish my whole position had been filled. A great trade with 61% return on investment the same day.

As I always say Carpe Profit one trade at a time you will see them grow your account. The trades will not always provide a 61% return but they all grow your account.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter (@jane_yul), Instagram (missairplanejane), LinkedIn and Facebook (@sugarairplanejane). carpeprofit@gmail.com or YouTube

Working on my book to be released this spring of 2017 available on Amazon and major retailers. Sign up here list for updates about when and where to preorder.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. Full Access Test Drive for $8.88 April 10-17th

Also testing out Stocks To Trade that has a 1 week $1 trial

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.