Coming off the holiday weekend and a 3 day trading week with travel on Friday I was very happy with my $3K+ day.

The new strategy of catching the end of day winners and riding the momentum overnight has been working. The news tends to carry at least one night With REN on Friday and today I made over $2800 on this name in two days. When there is strong momentum with a stock, especially low float it is easy to rake in the profits.

However with a low float stock it does also bring volatility which can cause drastic price changes. In order to continually profit it is important to have an exit plan in place. As I learned from another trader it is important to have your exit plan set up when you enter a trade. I usually pay attention to price action to help determine my exits and as the price rises I uses stops to protect profits should it tank. I’m finding that with the lower float stocks stop limits don’t always execute because the price action can be so whippy.

Today while at the Doctor’s office in the waiting room, I watched the price action on REN. I saw the selloff at noon and rocked a trade right before 1230. Then I my blood pressure was taken as a routine check. Well it was a little higher than my usual but still great 125/70. I mentioned to the nurse I thought it would be higher because I had just exited the trade locking in another great profit. Then she asked how do I learn. Simply check out my blog.

It is not something that is learned overnight as you have seen throughout my blog now. Day trading takes time to learn the market. I’m still learning new things everyday. I have noticed with my trading while pregnant I’m trying to diversify. I’m not sure it that is a good thing or not. I want to be effective at a couple different trades.

Lately the strong end of day movers have been gapping up nicely. Today I found a new way to scan for stocks ending up at the highs of their day with the charts and even 52 week breakouts which is why I went long $LMAT at 20.86.

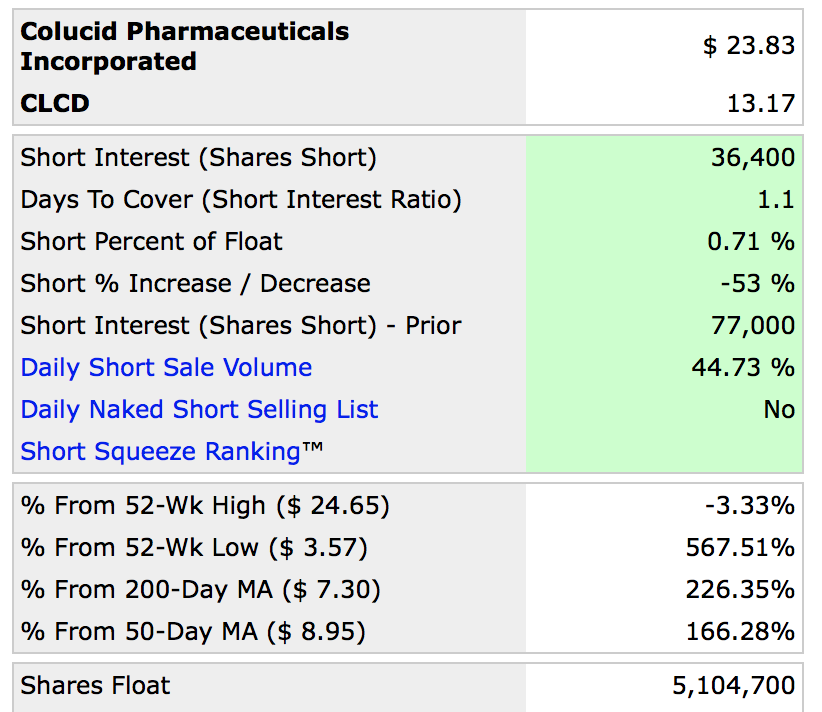

The biggest gainer of the day $CLCD had a great end of day run up from 21.80s. It ran all the way up to 24. I had an entry at 23.54. I should have exited when it dropped to 23 with a stop. and re entered down at 22. I need to get better at stops to protect the drops.

I’m diligent about protecting my profits on the way up, but for some reason I am not the best about a stop on the way down. Rule #1 is always cut your losses early. It is not always easy to take a loss. But the patience of a good or better entry does pay off.

Once I saw CLCD break 24 for the second time during power hour I bought a small swing position at 24.12 and saw it closed up after hours at 24.40. Looking for a gap up above 25 Wednesday morning. CLCD is a lower float stock with 5.1 Million in the float and a fairly high daily short sale volume.This is what interested me in swinging a stock already up 123% for the day.

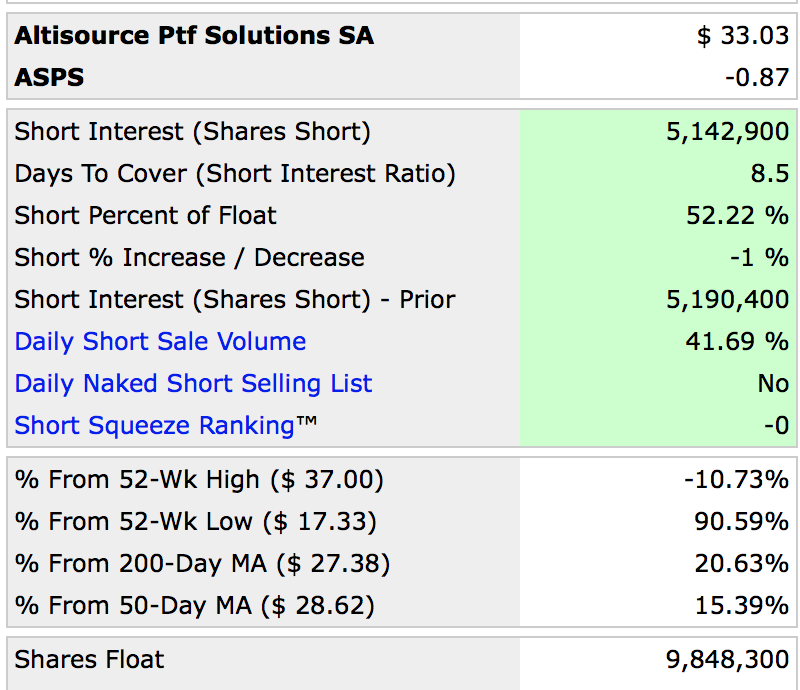

My other swing trade for the night is the trade of the week from Trade Ideas. I bought a small position of $ASPS with 9.8 million in the float and 52% short interest. The short interest can create a snowball effect with momentum. The whole basic supply and demand of shares available and the shorts wanting to cover to lock profits or minimize losses.

I do still love my bottom bounce reversals, but I have found going with the momentum tends to be a bit less stressful than the bounce. The bounce plays when timed right are fast and easy money to be made.

I have to say I have had some great emails to carpeprofit@gmail.com about people letting me know how my experience has kept them motivated. It is touching to know that I can help people around the world even when I have losses. The name of the game is keeping your wins bigger than you losses.

We are imperfect as humans and have emotions, so those losses are expected sometimes. And just because you locked a loss it doesnt mean it is a poor trade. Did the price action continue to go against your plan then it was actually a smart trade for stopping the loss.

We all learn from each trade. I’m still learning everyday and I am looking forward to the convention in Orlando where I hope to learn more. As a profession I’m passionate about I don’t get bored learning new things in the field. I’m still a newbie, granted a profitable newbie. There is so much and it does not happen in one day. Looking to have more great days like today.

Goals for September:

- Patience on Entries

- If it goes against me cut losses quickly.

- Try to let the profits rise and not sell too quickly.

- See if the new momentum overnight trades work well. Will that work for long and shorts?

- Write down the trades as they happen and enter trades nightly. (Pregnancy has me tired more quickly)

We all get better when we step outside our comfort zones and challenge ourselves. So take a step forward and try to learn something new. When you put in the effort the reward usually follows. Just make sure to follow the rules. It’s always good to analyze your trades

See you in the morning on Twitter and Carpe Profit one at a time to grow your account.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook. carpe profit@gmail.com

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room.

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.

Hello, Jane!

Can you share, please, cloud link for your Trade Ideas scanners? It will really help. Thank you!

I use a couple different ones what in particular are you looking for?

I like your reversal pattern, how do you spot pre-squeeze stocks.

Jane, you can send me TI scanner links to ryavit@msn.com

Thanks in advance.

When you do bottom reversals what is the your stop loss? Is it 50cents below your average purchase price or 100cents below your average purchase price?

I try to enter as close to the reversal as possible but I’ve been setting my stops at the low of day or up to .25. It depends on each trade

Hey Jane, I totally agree that trading is not something that can be learned overnight. The psychology aspect of it takes a while to grasp. It has taken me about a year to finally realize that cutting losses in order to keep profits is the only way that an account will grow. Great work!