Swing Trades for this week $REN $SPU and $RJETQ

If you have been following my trades you will see I’m attempting to try to add a new styles to my trading. It is the breakout fill the gap and the overnight momentum plays.

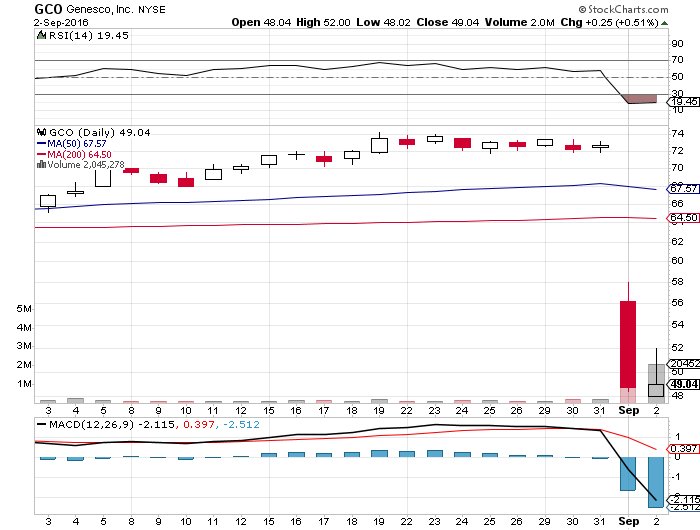

With the breakout to fill the gap I look for a chart where it has had a huge overselling of the price recently. A big example of one I will have on watch with a price alert is $GCO

As you can see on September 1st they had poor future estimates for the company and it tanked. First it opened down at $56 from a previous day close of around 73. It sold off all day down to around 48.50. I played this one for a bottom reversal play with shorts covering from the long weekend. For those that went short on Wednesday August 31st they were definitely happy with roughly $25 a share profits in the crash. This one will take more time to recover and I will put it on my watch list for when it finds a bottom and starts to uptrend. Once it breaks that HOD (high of Day) for the 1st of 58 it should start to fill the gap. There is a nice void from 58 to 72 a $14 gap to be filled. It probably wont happen as quickly as it occurred but it should create some momentum.

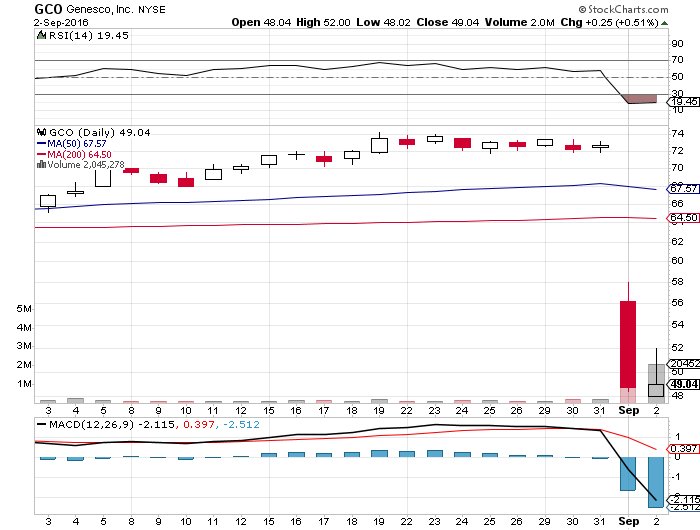

I am also working on Overnight Momentum trades like with $REN

As you can tell with $REN it is in breakout mode. July 11th it started to spike up and doubled in value from $4 to $8. This stock is one of my favorites with a low float of 10.8 Million and a short float interest of roughly 14% now. There was a secondary surge in the beginning of August with positive earnings and positive forward looking outlook for the company. This third wave is a break out of the company’s 52 week high. It closed on Friday with a price of $22.03 and had a high after hours of 22.74 before closing after hours at 22.59. This low float stock had an amazing day Friday. It broke out new 52 week high and the low float with shorts that tried to short at the high should have them covering on Tuesday.

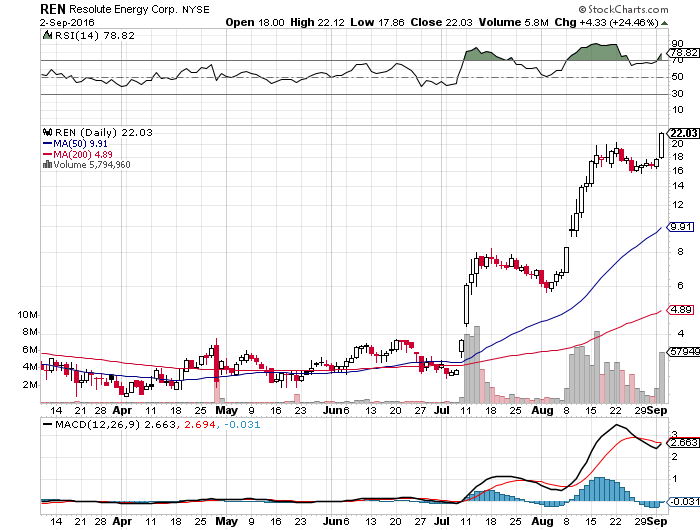

$SPU is another one that is known to run.

On Friday it hit a new high for the week with a sell off right before close. This Stock has 994K in the float so less than 1 million which leads to volatility. They just won a contract in China on the 31st of August which caused a huge spike on the first and the second. With such a strong finish on Friday looking for the continuation of the move on Tuesday. With move volume we could easily see it hit up to 15. I will have a stop as this is a volatile stock and could easily whip the other way.

My third stock I’m excited about for Tuesday is $RJETQ. If you have been following me on Twitter you know this is one of my long term holdings. Republic is a bankrupt airline stock. As with American Airlines when I purchased it in bankruptcy I knew it was going to come out restructured and more powerful financially. Republic filed Bankruptcy to eliminate certain aircraft from their fleet as well as the extra costs such as maintenance, hangar rental space and more. They also filed in order to go through contract negotiations again after it took them 7 years to finalize this newer costly contract last June. This company is concerned on bottom line numbers and did this simply to save money. Now that they released this 8 K SEC filing. and have come to an agreement with American, the 3rd and final airline. Now they will be able to petition to exit bankruptcy. This is huge and could be the catalyst that causes this stock to go from a close Friday of $0.88 to well over $2. The stock traded at a high of $15 in the past year and a half.

I do well with the reversals, but I’m trying to broaden my repertoire and this week I’m due to hopefully fit in a one on one training with Dan Mirkin from Trade Ideas about learning Options.

I think Options would be good for me as I tend to see bottom reversal setting up on higher priced stocks and to my knowledge I would be able to leverage my capital better with options rather than buying the shares outright. We’ll see I need to learn before I jump in head first.

This holiday weekend has been a great time with the family and this extra weekday off I use for studying and will be expanding my knowledge to learn more about options. I’m excited about Friday , where I will be heading to Orlando for the Trader and Investor Summit. If you will be there and want to meet up I’m planning and meeting some people at Hooters on International Blvd. from 8-10. It will be a long day of travel and I get exhausted more quickly now that I’m 4.5 months pregnant so an earlier night for me. If you can make it I would love to chat in person.

I love hearing feedback from you. It makes my trading more personal and I like to hear how I can help you. If you have questions or comments you can contact me here or on Profitly, Twitter, Instagram, LinkedIn and Facebook.

The tool I use for scanning and alerting is Trade Ideas who offer an always free trading room. They have an amazing discount going on through Monday Sept 5th with promo code LABOR2016

For my charting and level 2 I use Equityfeed.

This blog is for information purposes I am not a registered securities broker-dealer or an investment adviser. The information here is not intended as securities brokerage, investment or as an offer or solicitation of an offer to sell or buy, or as an endorsement, recommendation or sponsorship of any company, security or fund.